Office to Residential Conversions: A Closer Look

The past few years, we have seen a seismic shift in how we use downtown buildings across the country. The pandemic accelerated the trend of remote work and left in its wake millions of square feet of vacant office space in downtown cores. In some cities, nearly one third of downtown office space now sit idle. In Cincinnati, vacancy rates are approximately 20%.

In response, cities across the country, including Cincinnati, are turning challenges into opportunities, converting these empty spaces to meet another pressing need: additional housing. Notably, Cincinnati is among the top cities for repurposing our vacant real estate into residences with an established track record of success and a robust pipeline of projects in the works.

How does Cincinnati stack up?

UPDATE: December 2024

A recent CBRE report ranked Cincinnati second in the country for office-to-residential conversions, second only to Cleveland. By the numbers:

- More than 9% of Cincinnati's office space is currently being or planned for conversion

- 3.2 million square feet of space is currently being converted in Cincinnati

- Cincinnati's conversion rate is four times the national rate

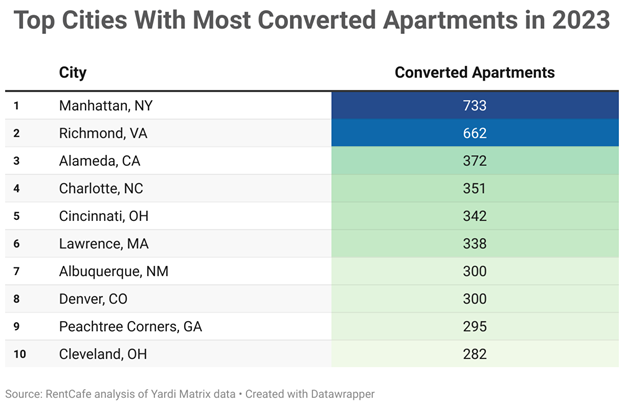

A 2024 report from RentCafe ranked Cincinnati fifth in the nation for residential conversions in 2023 and 11th in the nation for planned apartment conversions, with more than 2,300 units in the pipeline and the majority of those planned units coming from office conversions.

In Downtown Cincinnati since 2000, over 1,300 new residential units have been created from office conversions, and nearly 500 more units are coming online by the end of 2024.

The Port played a role on more than half of these projects, primarily through our Public Finance practice, but also leveraging our unique development toolkit.

Below is a look at the completed, in process, and planned office to residential conversions since 2000 in Downtown Cincinnati.

Ohio Among the Top States for Conversions

Ohio is the only state represented twice within RentCafe's top ten, and a recent CBRE analysis ranked Cleveland and Cincinnati first and second in the nation in conversions as percentage of overall office square footage. Developers point to a couple of key factors that help make residential conversions more feasible:

Older building stock – Perhaps counterintuitively, older buildings tend to be better suited for residential conversion. Buildings designed up to the 1970s were designed with shallower distances from windows to building core to take advantage of natural light.

Incentives – Ohio’s State Historic Preservation Tax Credit (HPTC) Program and Transformational Mixed-Use Development (TMUD) Program are frequently cited as critical tools in making the overall financing of these complex conversion projects work.

The Port has partnered on many of these conversions locally, either as a development partner or providing public financing. The combination of incentives and resources, like those The Port offers, can help make these difficult projects financially feasible.

A Quick Look Across the Country

The city with the largest conversion in the Country: New York, NY

Perhaps unsurprisingly, New York is leading the country in terms of pure scale of individual projects. Mammoth office buildings, which previously maximized their square footage in the country’s most expensive real estate market, can accommodate a considerable number of residential units. The largest conversion in the country, 25 Water Street, tops the previous title holder, also in New York.

Built in 1969, the 25 Water Street conversion showcases some of the challenges of repurposing more modern office structures. Large, expansive floors under fluorescent lights and with conditioned air may maximize usable office space but make for a far more difficult conversion than older buildings that depended on natural lighting and ventilation. The developers needed to make significant changes to the façade and add two light wells to bring more daylight into the building for residential use.

Another consideration unique to New York is the city’s zoning code. With the size of new apartment buildings capped, office conversion can allow for more residential square footage than construction of a new residential building on the same site. 25 Water Street not only maximizes the number of apartments within the existing building envelope, the project also adds additional penthouse units through construction of a glass structure above.

The metro leading the pack: Washington, DC

The Washington, DC metro area tops the list in 2024, with 5,820 units planned or underway through office conversion. The Elle Apartments repurposes the former Peace Corps Headquarters in DC’s Golden Triangle Business Improvement District. Encouraging office to residential conversions is called out in DC’s Downtown Action Plan, a 5-year economic development strategy released in early 2024, which cites the challenge of fewer than five housing units for every 100 employees in Downtown DC.

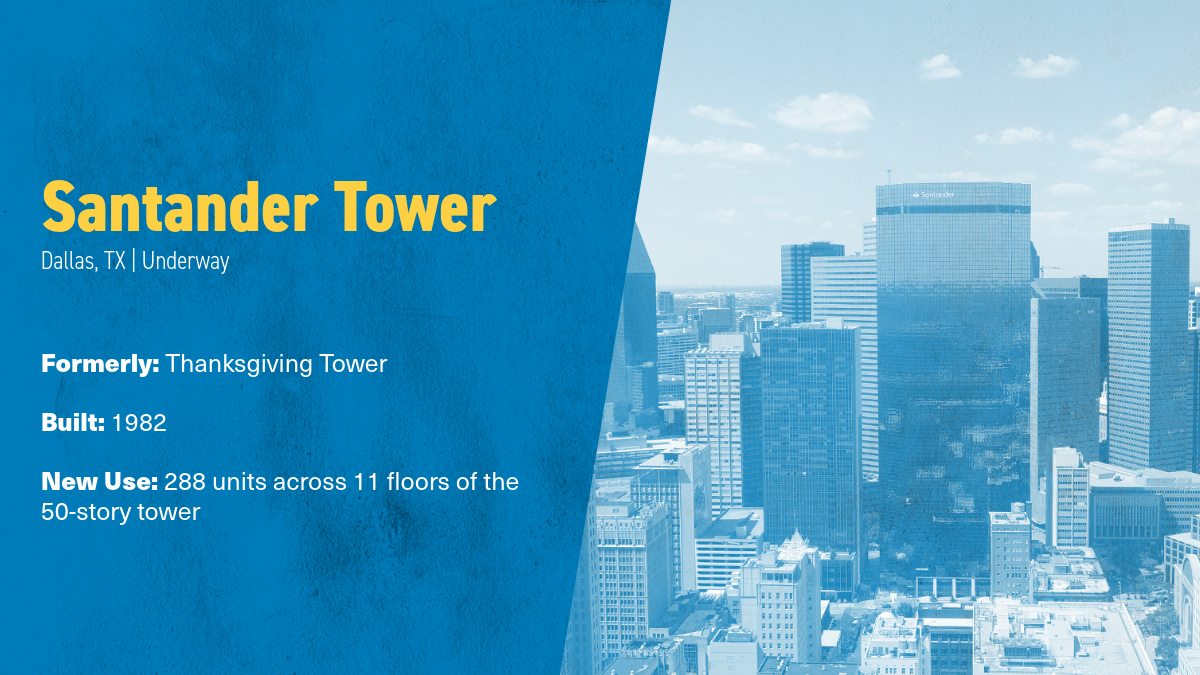

The city laser-focused on residential conversions: Dallas, TX

Dallas may come in third in terms of number of units being created, but with 83% of its conversions planned or underway representing office to residential, it is clearly focused on making the most of its nearly 20% office vacancy. The Santander Tower project represents a mixed-use, blended approach to existing office space. The project converts eleven floors of the 1.4 million SF office tower to 288 luxury residential units. Renovations also look to add amenities like a pool and fitness room. The building also incorporates office space, dining options, and a boutique hotel.

The city facing some of the highest vacancy rates: San Francisco, CA

Finally, with nearly 30% of its office space vacant, San Francisco is exploring opportunities to find new uses for its vacant square footage. Developers can look to 100 Van Ness, completed almost a decade ago now, as a model. A combination of the building’s design elements, a newly adopted Area Plan, and supportive land use policies helped make the project possible. Replacing the existing precast façade with a unitized glass curtain wall required no seismic retrofits, a major concern in San Francisco, and the 15,000 SF floor plates were ideally sized for residential.

Major Benefits of Office to Residential Conversions

Provide much needed additional housing units

Conversions help fill the critical need for additional housing. Office buildings are often located in areas of the city with the most transit options. Residents working downtown can benefit from shorter commutes. Additionally, an influx of residents brings people and vibrancy back to Downtown cores, supporting small businesses and boosting tax revenues for the City.

Reduced Supply Creates Increased Demand

Older office buildings, often most suitable for conversion, also tend to lack the modern amenities and wide open floor plans of newer, Class A developments. That lowered value makes the prospect of trading commercial for residential rents financially feasible. Additionally, by removing excess, often lower value B and C commercial space, cities can increase the value of remaining office space.

'The Greenest Building is One that Already Exists'

This quote by Carl Elefante, former president of the American Institute of Architects, perfectly encapsulates the sustainability considerations of reusing an existing structure rather than tearing down and building new. Renovation and reuse can significantly reduce carbon emissions over new construction, particularly when reusing building elements with significant embodied carbon like the building foundations and structure.

Major Roadblocks of Office to Residential Conversions, and How Cities are Addressing These Challenges

Financial Feasibility

Making a building suitable for residential when it was designed for another use can be an expensive proposition, requiring anything from completely reworked plumbing and mechanical systems to a new cladding system to light wells being cut unto the floor plates. Even buildings with the ideal building form, floor plate depth, and window to wall ratio require extensive modifications for residential. Add in additional soft costs, heightened construction costs, and current interest rates, and without incentives, a residential conversion could generate less value than a mostly empty office building.

Cities across North America are considering, and putting into place, incentives specifically designed to spur office to residential conversions. For example, the conversion of a building in Honolulu leveraged an incentive specifically geared toward projects incorporating affordable units. Additionally, the White House recently released a guidebook to federal resources for residential conversions as an opportunity to "to increase housing supply, improve affordability, ultimately create efficient, zero-emissions housing, reduce long term energy costs and volatility, and thereby contribute to local, state, and federal climate goals."

Regulatory Barriers

Differences in zoning and building code requirements can also pose major roadblocks to conversion. Residential use often brings different parking and open space requirements, and older buildings, while more suited to conversion physically, may require considerable upgrades to bring them up to modern residential building code. Cities across the country are increasingly looking into solutions reevaluating and relaxing existing regulatory barriers to residential conversion projects.

Challenging Building Forms, Existing Facades, and Systems

The New York Times appropriately compared office to residential conversions to solving a Rubik’s Cube. A building suited for offices may not offer adequate access to light and ventilation and open space requirements. Older buildings tend to maintain a maximum 20-30 foot distance from (often operable) windows to building core, whereas newer buildings often incorporate much deeper, and more complex floor plates with significant square footage of windowless conference spaces, server rooms, and more.

Fun Fact: Gensler, in an October 2023 study of building conversion feasibility in San Francisco found that “high-rise buildings with floor plates of between 12,000 and 20,000 square feet with ribbon or punched windows” provide the most ideal design characteristics for conversion.

Office to Residential Conversion: Here to Stay

With office to apartment conversions more than quadrupling since 2021, it’s clear this is a trend that will continue to shape cities across the country for years to come. Just as cities have done throughout history in response to major changes, they will continue to adapt and change to meet the needs of the people who call them home. What do you think will be the next major trend to shape our urban core?

Additional References and Resources:

National:

New York Times: Here's How to Solve a 25-Story Rubik's Cube

NAIOP Research Report: New Uses for Office Buildings

Bipartisan Policy Center: Converting Vacant Offices to Housing: Challenges and Opportunities

WhiteHouse.gov: Commercial to Residential Conversions: A Guidebook to Available Federal Resources

HUD: Office to Residential Conversions Highlight

SPUR: From Workspace to Homebase

The New Localism: The Next Downtown: Financing Office to Residential Conversions

Local:

Cincinnati ranks second in U.S. in new CBRE real estate report

RE Business: Cincinnati Office-to-Multifamily Conversions are on the rise

WCPO: City council aims to turn vacant downtown Cincinnati offices into residential units